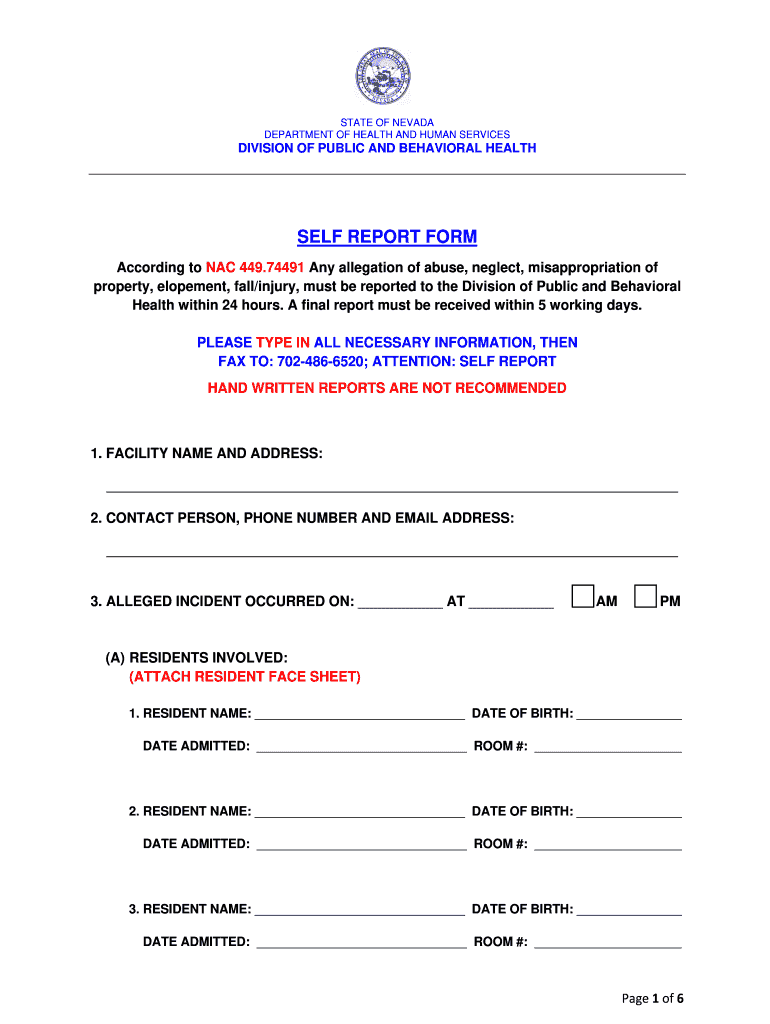

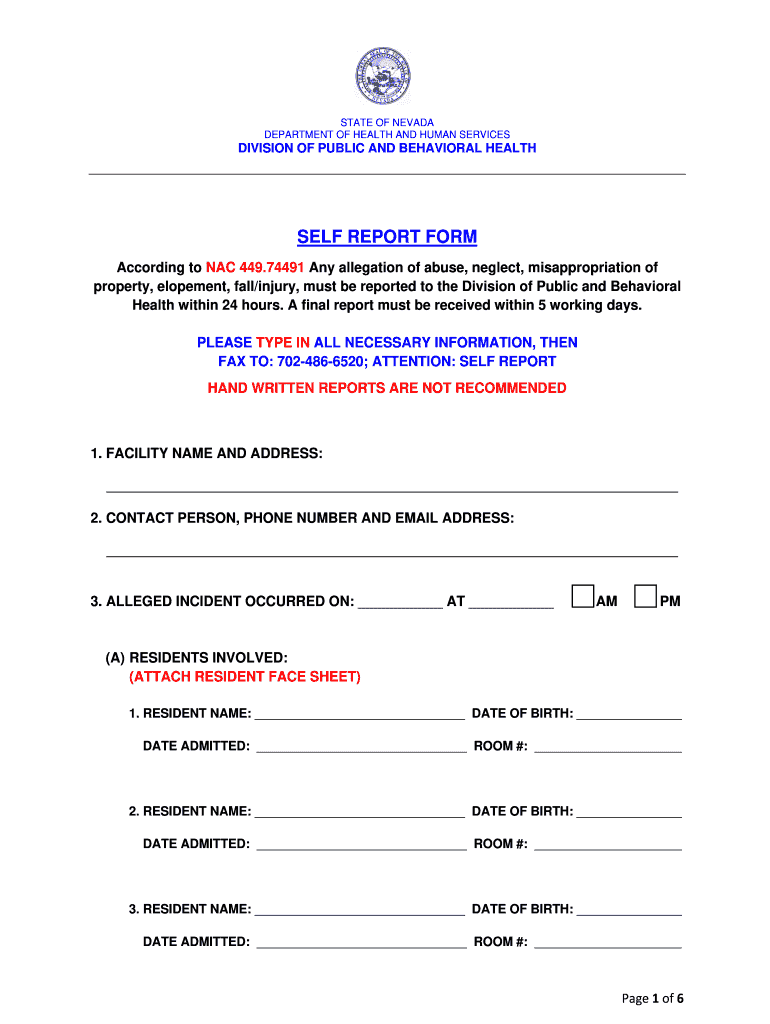

Get the free nv self form

Get, Create, Make and Sign

How to edit nv self form online

Video instructions and help with filling out and completing nv self form

Instructions and Help about nv self report form

So why formative an LLC well recently Nevada has improved their LLC statutes making it the most favorable state in which to form an LLC now let's list some benefits first of all the names of the members or corporate shareholders for that matter and CEO are not filed in the public records in Nevada has zero business income tax on corporations or LLC×39’s they also have no personal income tax Nevada does not share financial records with outside agencies you do not have to reside in Nevada to form an LLC there Nevada offers protection for acting members and managers of corporations and LLC's nonperson LLC offers charging order protection so that when an owner is sued the law can protect the member from losing the company or the assets insideLLC'’s and corporations in Nevadan offered stock or LLC membership in exchange for services work real estate cash and more all CD×39’s are flexible interns of management that is you done×39;even need to be a member or owner of Nevada LLC in order to have a hundred percent control of the management Nevada offers flexible profit distribution regulations to all CD×39’s and finally Nevada minimizes the rest time and cost of potential commercial litigation now after considering forming a Nevadans e let's first discuss exactly what an ALICE II is an LLC or a limited liability company gives limited liability burs known as members and offers pass-through tax structure by default with a pass-through tax structure the business does not pay taxes on its own income instead any gains or tax deductions a passed through to the owners and are filed on their personal tax returns furthermore you ghetto choose the tax treatment of your Nevada LLC you can choose to have it treated as a single member or soleproprietorshipor partnership for tax purposes it cane taxed as a C corporation or Corporation as with any state there awesome guidelines you must follow when setting up an LLC in Nevada but thereat also some significant advantages let's detail some benefits of forming an LLC in Nevada number one member's shareholders that is owners as well as CEOs and nonregistered officers are not a matter of public record Nevada provides privacy for business and corporate owners in Nevada you can have nominee director or nominee manager that will act as the public face of your company should you wish because Nevada corporate law states that the names of the manager and some corporate offices and directors must be publicly filed your nominee will have no real control but will show up in the public records as a nominee meaning in name only this person does not necessarily have an authoritative position in the company using this option can help further your anonymity for those associated with a company in Nevada and naturally this service is to be used for ethical and legal purposes only owners of privately held Nevada all-seasoncorporations do not need to have the names disclosed in the public records undoing these members and shareholders...

Fill nevada self report online : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your nv self form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.